Asmodee, the world’s largest board game publishing and distribution firm, has its sights set on more than twenty firms it is considering acquiring, according to a presentation given to potential investors in November. Though currently part of Embracer group, Asmodee will be an independent company again before the end of April 2025, and has secured a $420 million (€400 million) cash injection to help it with its plans.

Asmodee Group is one of the largest and most important board game publishers and distributors in the world, with an international distribution and marketing network, and many subsidiary board game studios. About half of the games on our guide to the best board games are published by Asmodee or one of its subsidiaries, and it provides international distribution services to the rest.

Speaking to investors at the Asmodee Capital Markets day event on November 19, current CEO Thomas Koegler laid out the firm’s route to growth. This includes a variety of strategies to drive higher sales of Asmodee’s games, and also a plan to acquire new “companies and IPs that are easy to integrate”.

By providing distribution services for so much of the board game industry and in so many markets, it already has working relationships with multiple studios, allowing it to identify those that would make good additions to its portfolio.

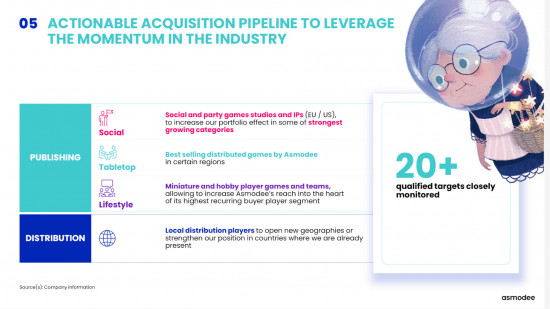

According to a presentation that accompanied Koegler’s talk, the firm has “20+ qualified targets closely monitored” – Koegler does not provide details on which firms these might be. These include “social and party game studios and IPs”, the “best selling” tabletop games distributed by Asmodee, “miniature and hobby”, and “local distribution” businesses.

Koegler states that growing by acquiring other businesses is a “proven strategy” for the firm, which has acquired 40 companies and IPs “all over the planet”.

Asmodee has been part of Embracer Group, an international investment vehicle that owns a variety of different creative businesses in the tabletop and digital gaming space, since 2022. It will be an independent business again in 2025, as Embracer has announced plans to divide into three separate successor firms, one of which will be Asmodee.

Embracer group secured loans worth $958 million against Asmodee’s assets in April 2024, with the funds used to pay back a different, equally massive loan for the group as a whole that was about to come due. Embracer has now, partly, repaid the favor.

On November 19 Embracer announced its plans to use funds from the sale of mobile gaming studio Minibrain to prop up Asmodee. $315 million will be used to “repay gross debt” while the rest will “further strengthen its balance sheet” and “allow it to resume its value accretive M&A strategy”. The deal is expected to go through early in 2025.

We reported at the time the loan was secured on Asmodee it was carrying a worrying amount of debt, almost four times its annual earnings. According to Embracer, now that it has been topped up with this new cash investment, Asmodee has a far healthier debt level, about 2.2 times its annual earnings.

However, there are strings attached. The cash is being provided in the form of an ‘equity investment’, or a partial sale of ownership. What form this deal takes is not specified, but it will mean that after Asmodee separates from Embracer group as a legal entity, a portion of its shares will be owned by Embracer’s successor in business.

If all that talk of money has you hankering for some cerebral gameplay, maybe some stock trading, our guide to the best strategy board games will have something to interest you. If it left you wanting to spend time with your favorite human, our guide to board games for couples will see you right.

Source: Wargamer