On the first day of the ComicsPRO Open House, Kristen McLean, Senior Executive Director The Circana Entertainment Knowledge Group, made a presentation on bookstore sales, based on data from Circana’s BookScan service.

Unit sales of graphic novels in the book channel were down 16% from 2022 to 2023, as the post-pandemic spike continued to level off, but are still higher than in 2017. And the decline may be slowing: The decline was 12% in the first half of 2024, relative to the first half of 2023.

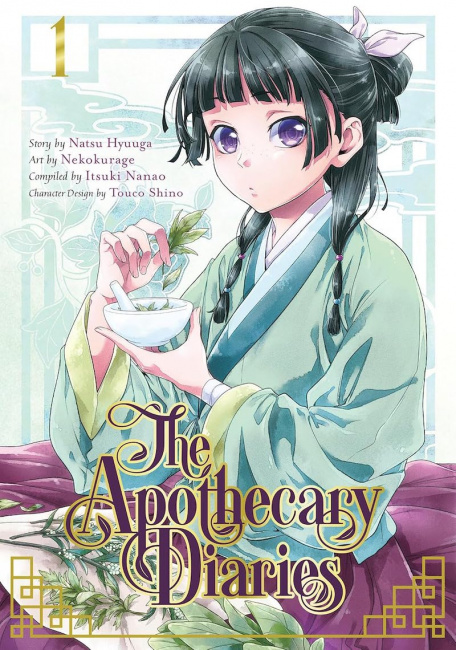

Manga leads the decline in the book channel, with print sales down 21% in the first half of 2024. Nonetheless, she said, “I urge you to keep with it, because I do think that the fans that we accrued during the pandemic are not going away.” Indeed, manga and other East Asian style comics, such as manhwa, made up the largest share of graphic novel sales in the book channel, with 40% of the market in the 12 months ending in June 2024. And whenever a new anime premieres, sales of the associated manga go up. The manga series that showed the biggest growth in unit sales in the first half of 2024 were

- Jujutsu Kaisen

- The Apothecary Diaries

- Delicious in Dungeon

- One Piece: Ace’s Story—the Manga

- Frieren: Beyond Journey’s End

- Demon Slayer: Kimetsu Academy

Children’s graphic novels are the second largest category, with a 32% share.

McLean’s advice to retailers:

- Prioritize community. “We’re still seeing a lot of interesting data points around people wanting to be out or connected to other people,” McLean said. “This is really important for us as local, independent businesses in this sector, if you’re involved in gaming or comics, because there is an opportunity to provide that for customers.”

- Have a wide range of price points.

- Look for opportunities to engage grandparents and multi-generational groups.

- Consider expanding adult fiction offerings. Sales of adult fiction have gone up for five years in a row in the general book market, and McLean sees opportunity there for comics retailers. “The things that are really great adjacencies for us, fantasy, romance, romantasy, horror, gothic, and mystery are all really strong right now,” she said.

- Stay the course on manga and collectibles, and in terms of gaming and building, keep in mind that women and girls are now major consumers in these categories.

Some other tidbits from the presentation:

- McLean painted a mixed picture of overall consumer spending and the factors affecting it: Inflation is slowing, the labor market is strong, and consumer confidence is rising, but on the other hand, the prices of housing and packaged goods (food, toiletries, etc.) are up, consumer debut is at record highs, and savings are depleted, with student loan repayment also putting a dent in retail spending. That said, entertainment spending is up slightly relative to other categories. The one group that is spending more is older high-income consumers, who are relatively isolated from economic shocks.

- The print book market as a whole is stable, with no change in unit sales in the first half of 2024 compared to the first half of 2023. The strongest category is adult fiction, which was up by 6% in terms of unit sales and 15% in dollar sales, and young adult fiction also posted gains of 5% and 8%, respectively. Adult and YA nonfiction and juvenile fiction and nonfiction were all down.

- Frontlist sales rose slightly, reversing the trend in recent years of backlist taking an increasing share of sales; adult fiction, YA titles, and children’s nonfiction are driving that growth.

- In the first quarter of 2024,

- Print books were 64% of the trade book market, audiobooks were 19%, and ebooks were 17%.

- Ebook sales are up 7% in the first half of 2024, driven by adult genre fiction and the “Kindle Girlies” trend on TikTok.

- Audiobooks showed the fastest growth, up 27% compared to the same period in 2023, and now have a larger share of the market than ebooks. McLean attributed this to the popularity of podcasts as well as the addition of audiobooks to music streaming services such as Spotify. Millennials are the biggest category here.

Source: ICV2