Based on growth rate, non-collectible miniatures and miniatures games were the strongest hobby games category in 2023, up around 9%, from $525 million to $570 million, according to ICv2 estimates. Collectible games was the only other category to book a win, and it was only up around 3%, while the other three hobby game categories were all down for the year.

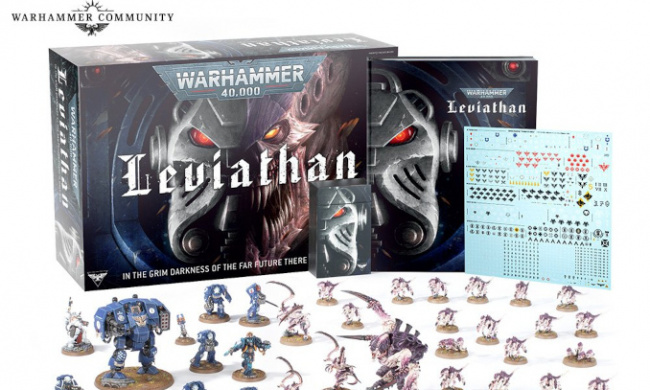

Miniatures giant Games Workshop led the way, with sales up around 15% in North America, according to ICv2 estimates based on its public filings. The launch of the new edition of Warhammer 40,000, announced a year ago at Adepticon (see “New ‘Warhammer 40,000’“), was the biggest driver; it kicked off with a bang behind a $250 box set (see “’Warhammer 40,000: Leviathan’ Heads to Preorder“) last summer.

The biggest obstacles to better Games Workshop sales are all self-inflicted, we heard in our interviews. Backlist fill rates are still not high, a problem that came to the fore during Covid and has persisted, and although retailers seem to be getting what they order from Games Workshop on most new releases, distributors continue to be heavily allocated.

A bigger problem, cited by both retailers and distributors, was the shortening of the preorder cycle, making it extremely difficult to gather demand info in time for initial orders to Games Workshop. Preorder info reaches Games Workshop customers on Sundays, and orders are due two days later.

The frenzy for WizKids Dungeons & Dragons miniatures has cooled, along with sales of the RPG.

BattleTech sales increased the fastest of non-GW lines in 2023, with the continued availability of the Beginner Box a big driver of customer acquisition.

Atomic Mass Games titles are doing well. Marvel Crisis Protocol was up year over year, behind the release of a new Core Set (see “’Earth’s Mightiest Core Set“) and increased SKU counts. Star Wars: Shatterpoint had a successful launch, bringing new life to the Star Wars franchise for the company.

For an in-depth analysis of these topics, see “Miniatures the Strongest Category – In Depth.”

For an overview of 2023 sales in the hobby games market, see “Hobby Games Eke Out a Win.”

For the top miniatures lines for Fall 2023, see “Top Miniatures.”

For more from ICv2’s Miniatures Week, click here.

Source: ICV2