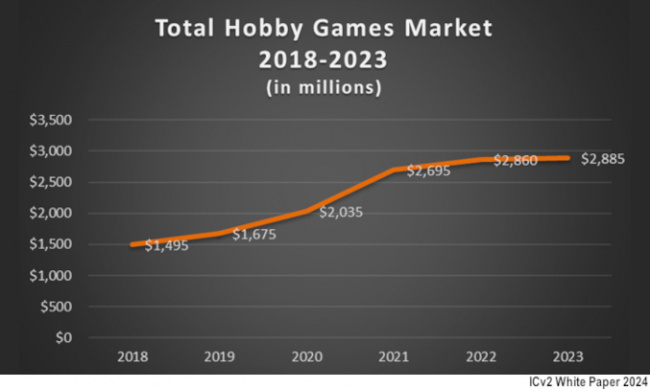

Hobby game sales eked out a nominal 1% increase in 2023, against the tough comparison to a third great year of Covid-fueled sales in 2022. Increases in collectible game and miniatures sales offset declines in board, card, and RPG sales.

We define “hobby games” as those games produced for a “gamer” market, generally (although not always) sold primarily in the hobby channel of game and card specialty stores. We define the “hobby games market” as the market for those games regardless of whether they’re sold in the hobby channel or other channels. Our estimates include sales in the U.S. and Canada.

The total hobby games market estimate is derived from estimates for five individual categories: collectible games (which include Trading/Collectible Card Games, Collectible Miniatures, and other collectible formats), miniatures (non-collectible), board games, card and dice games, and roleplaying games.

Our primary means of collecting data about hobby games sales is interviews with key industry figures with good visibility to sales in various subcategories and channels. We also review data released by publicly traded companies, publicly available Circana data, and crowdfunding data and analysis.

For the full ICv2 White Paper presentation which first presented these trends, see “ICv2 Hobby Games White Paper 2024.” For last year’s report, see “Hobby Game Sales Up 7% in 2022.”

2023 Trends

We estimate hobby game sales in the U.S. and Canada at around $2.885 billion for 2023, up around 1% from sales in 2022. While the nominal increase was less than the rate of inflation, holding at the previous year’s sales levels was an impressive performance for a market that had gone up a total of over 70% in the previous three years. The feat was accomplished despite declines in three of five hobby game categories.

There were contributions from impactful difficult-to-replicate events, including the release of The Lord of the Rings Magic: The Gathering set, and significant shifts in consumer behavior, but a win is a win.

Consumers

Consumers continued to buy despite the absence of government stimulus, prices that had gone up pretty dramatically over the previous two years, surging out-of-home dining and entertainment, and revenge travel on an impressive scale. But then, as we’ve noted in the past, the American consumer is a tough beast to bring down.

Publishers

Product proliferation was the name of the game at the publisher level, as the shortening of development and manufacturing pipelines brought delayed products into the market and allowed new products to flow relatively smoothly.

Retailers

The second year since the release of effective Covid vaccines and treatments brought store traffic fully back to pre-Covid levels or above, but retailers had to navigate costs that were markedly higher than the year before, especially for labor and rent. Despite these challenges, hobby game retailers ended the year in relatively healthy shape, distributors told us. Store counts were reported as flat to up.

Sales in the hobby channel were up a modest 2%, despite declines in some categories. This made 2024 the 15th consecutive year of growth in the channel, with a huge surge in the 20s.

A Look by Category

Collectibles and miniatures were the only two 2023 growth categories; board games, card games, and roleplaying games were all down. Although there were differences by product, sales of lifestyle gamer products generally held up better than those appealing to more casual consumers.

The dominance of collectible games as a category continued in 2023; it is over half of hobby game sales, larger than the other four categories combined.

Watch for our category-by-category trend analyses over the coming days.

We have an in-depth analysis of the trends above on the ICv2 Pro site (see “Hobby Game Sales Eke Out a Tough Win in 2023 – In Depth“).

Click Gallery below for full-size charts and graphs!

Source: ICV2