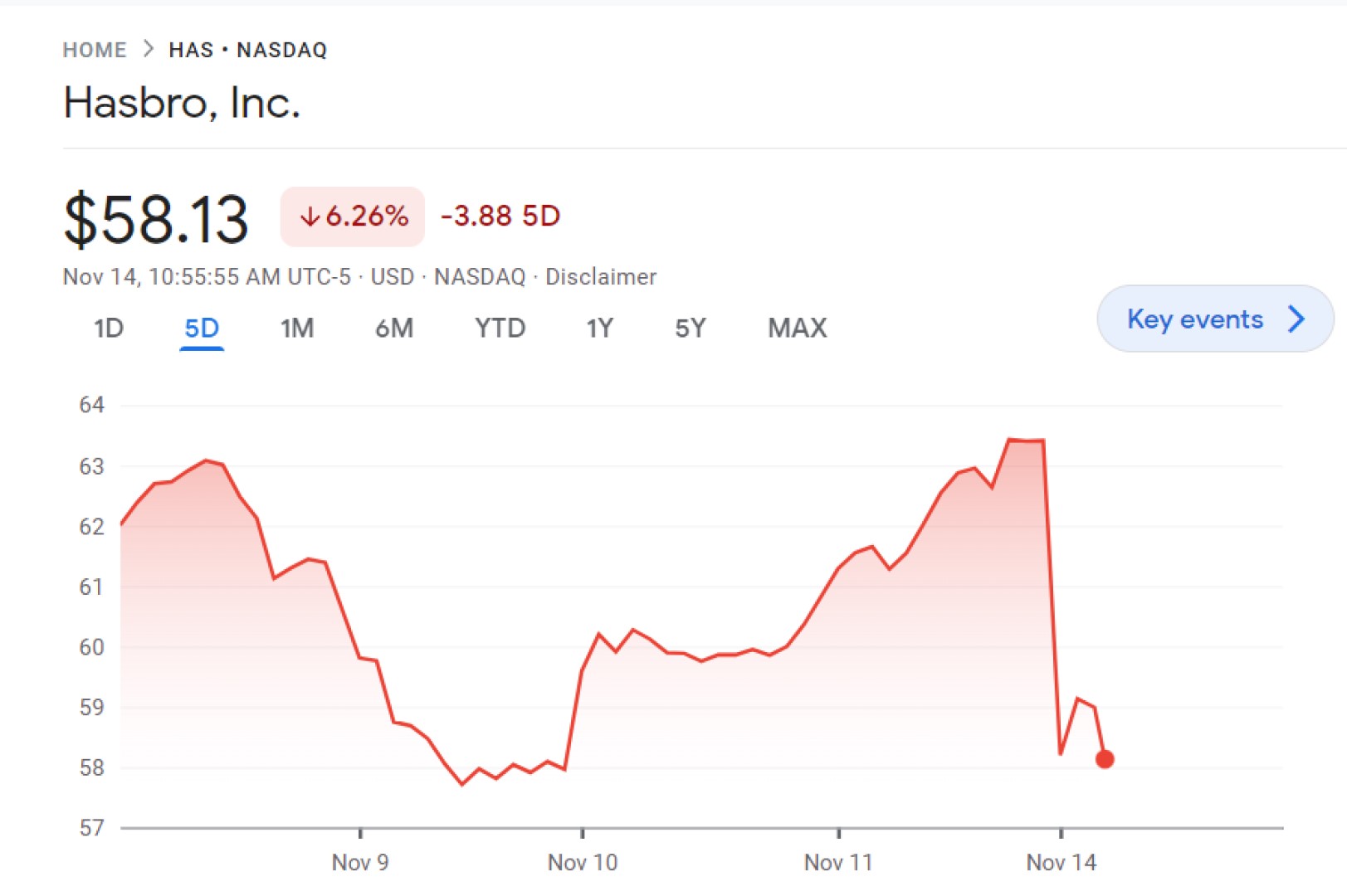

Toy company Hasbro has seen its shares drop around 5% in pre-open trading on November 14. This is thanks to a deep dive from Bank of America (BofA) that claims the overproduction of Magic: The Gathering cards is “destroying the long-term value of the brand”. The quote comes from BofA equity research analyst Jason Haas.

According to the financial news website investing.com, Haas says that BofA spoke to “players, collectors, distributors, and local game stores” about their “growing frustration” with the trading card game as part of its deep dive. “The primary concern is that Hasbro has been overproducing Magic cards, which has propped up Hasbro’s recent results but is destroying the long-term value of the brand”, he adds.

Investing.com says Magic currently accounts for around 15% of Hasbro’s revenue. Bank of America previously recommended Habsro’s stock, placing it in the ‘Buy’ category. However, after the evaluation, this rating has been double-downgraded to ‘Underperform’. Stock is considered underperforming if there are concerns its value is not keeping pace with the wider market.

The exact drop in Hasbro’s stock seems difficult to define. Business news website CNBC says the stock has dropped 5.2%; financial news website investing.com claims the drop is “more than 6%”; and financial market website Seeking Alpha says the shares fell 5.38% in Monday’s pre-market trading.

Haas also points the finger at a few other factors that may be contributing to the destruction of Hasbro’s share value. As reported by investing.com, Haas says “players can’t keep up [with increased product releases] and are increasingly switching to the ‘Commander’ format, which allows older cards to be used”. “The increased supply has crashed secondary market prices, which has caused distributors, collectors, and local game stores to lose money on Magic”, he adds. “As a result, we expect they’ll order less product in future releases.”

Additionally, Haas claims the controversial Magic 30th Anniversary set has contributed to Hasbro’s problems, calling its $999 price “excessively high” in investing.com’s report. “This has created panic among collectors and we’re seeing collections being liquidated now that the scarcity value of Magic is in question”, he says.

Haas’ findings were also reported by Seeking Alpha on Monday. “Seven of the last eight major Magic releases have declined in value, and Hasbro continues to reprint its most successful sets, driving prices down further”, he says. “Our store checks have also found that many national retailers are cutting Magic, and those that continue to carry it are heavy with aged inventory.”

Despite 2021 being the best year ever for Magic financially, MTG publisher Wizards of the Coast reported its Q3 revenue dropped $60 million between 2021 and 2022. Wargamer has reached out to Wizards of the Coast for a response to the deep dive but has not yet received a reply.

You can read more about the falling stocks in the reports from CNBC, investing.com, and Seeking Alpha. You can also learn why MTG fans are angry about the 30th Anniversary Edition boosters here at Wargamer.

Source: Wargamer